If you choose to be self-employed, then that means that you are willing to take the responsibility of handling all your income and also expenses here. Been self-employed means that you can handle things like having a self-employed payroll and you can click here for more. Creating a self-employed payroll is therefore a great way to grow your business as you would like. This is why you should be well-informed on how to make and handle a self-employed payroll. You are advised to search for a self-employed payroll platform that you can utilize when it comes to getting a self-employed payroll. Here are the tips that you should look into when you are picking a self-employed payroll platform.

First and foremost, you are supposed to look for a self-employed payroll service provider that is qualified for this job. You are supposed to go for a self-employed payroll solution center that you are certain about. This is why you are advised to check if the self-employed payroll platform is certified. The best self-employed payroll platform is one that has been used before and is still been used and hence read more now on this homepage. This is the kind of self-employed payroll solution center that has been developed well to fit the needs that you will have. You are supposed to look into the remarks that the self-employed payroll solution center.

There are several self-employed payroll solution centers that will give you a self-employed payroll software that will help you in the needs that you have. You are supposed to click for more factors to consider using the self-employed payroll software for you to get to do things yourself. The automation that is provided by the self-employed payroll software is what will help you have a simpler time. You should therefore check for the most used self-employed payroll software in the market. You have to understand the means the self-employed payroll software is meant to operate. This is how you get self-employed payroll software that is great.

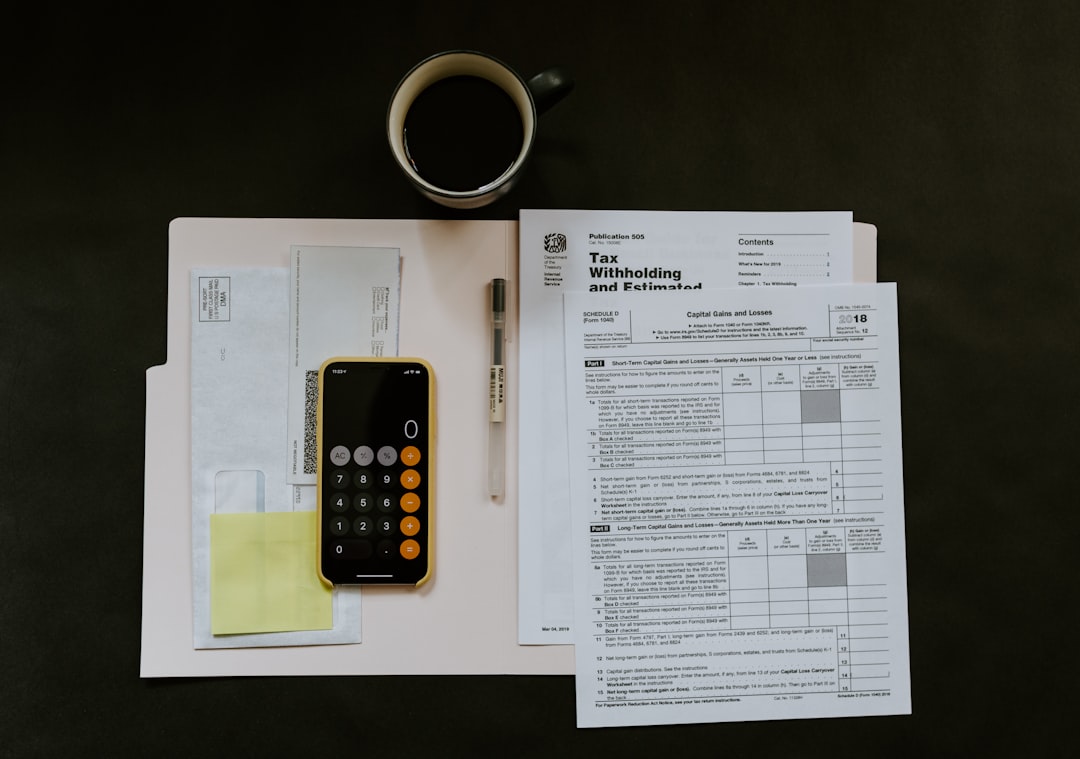

Finally, you are supposed to understand the kind of self-employed payroll taxes that one is supposed to pay as you discover more. You have to be aware that the gross income of your business is what matters whenever you are dealing with self-employed payroll taxes. You should be aware that your money is not in any way involved in the self-employed payroll taxes that are needed. Therefore, you are free to withdraw whatever amount you want from the business that you have. You have to make sure you have banked your income in the business well. You are supposed to be very smart with how you are going to get the income budgeted.